We live in an age of digitalization, where all payments, online purchases, taxi orders, money transfers, etc., are made online. Cash and card payments are losing their popularity as one-touch payments become mainstream. Mobile wallets like PayPal and Stripe have been long gone. But advances such as digital authentication and the principle of “buy now, pay later” are constantly changing the mobile payment market.

In this article, we will talk about Klarna, the Swedish mobile payment app that has ushered in a new era of online shopping. Finally, we’ll discuss how to сreate a Klarna clone, the typical features of mobile payment apps, and monetization models. Excited? Let’s dive deeper!

Table of Contents

- 1 What is Klarna and How Does It Work?

- 2 Typical Features of a Klarna Similar Apps

- 3 Tips to Consider Before Klarna Clone Development

- 4 How to Create a Klarna Clone: Main Steps

- 5 Most Popular Similar Apps to Klarna

- 6 How to Make Money with a Klarna Clone?

- 7 How Much Does It Cost to Build an App Like Klarna?

- 8 What Technologies You Should Choose

- 9 Wrapping Up

What is Klarna and How Does It Work?

✅ Klarna is a Swedish application owned by Klarna Bank. This is one such application that helps users to control their budget. Customers can add products to their carts and receive them immediately. Users must pay for the purchase either within 30 days or in installments.

✅ The registered payment card is used to pay the payment amount. As mentioned earlier, the user should not incur any additional costs or interest for transactions made using the application.

✅ The Klarna app has gained immense popularity by bringing in Snoop Dogg as one of the investors. It is one of the first companies to enter this segment and has been a huge success.

Klarna is a large private fintech company in Europe. Here are some numbers to prove it:

- An average of about 42,000 downloads per day.

- Over 16 million downloads in total.

- In the first quarter of 2020, the Klarna app was downloaded nearly 300,000 times more than our direct competitor in the US.

- Ranked #1 shopping app in all markets where it is available.

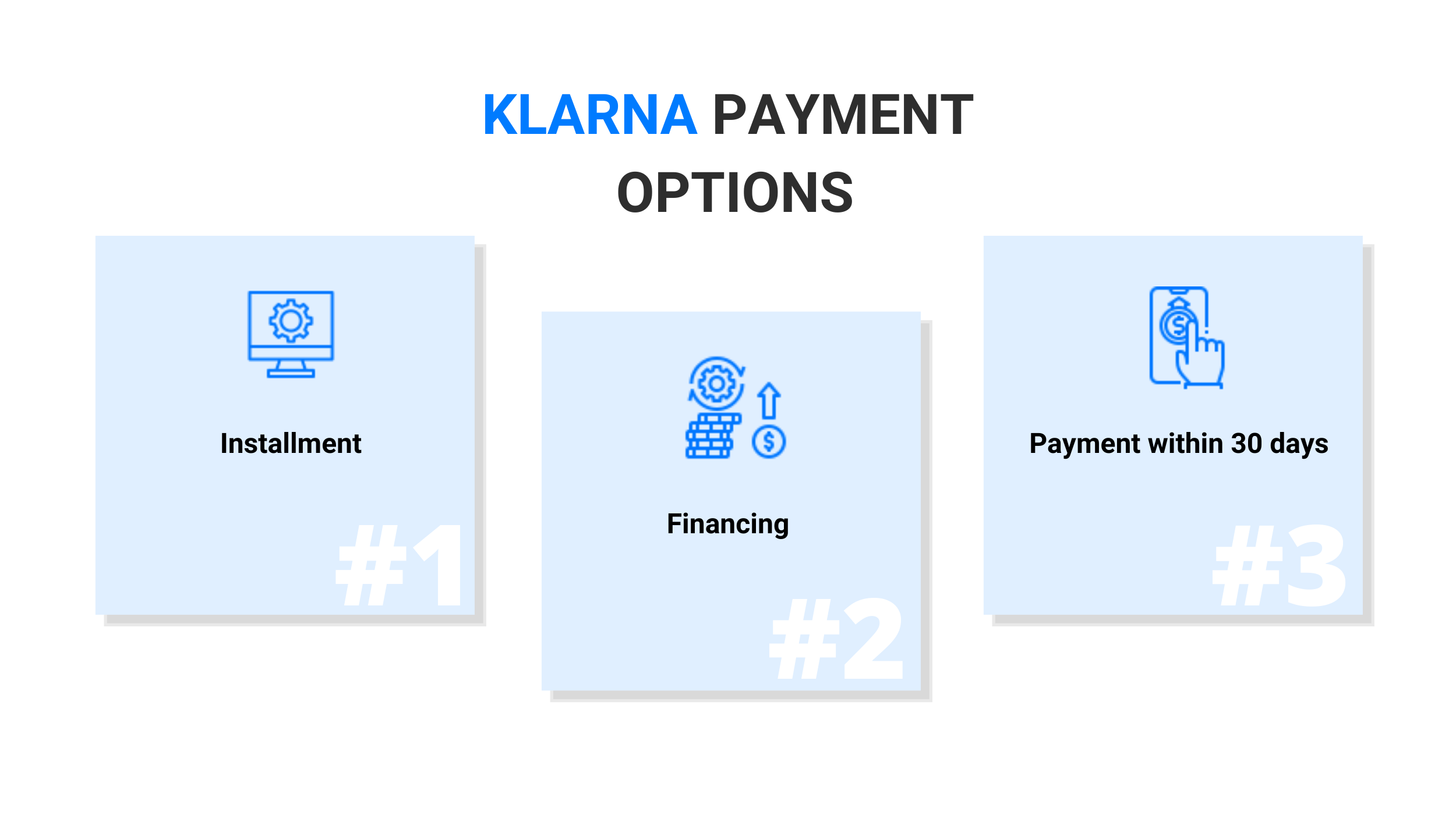

Let’s also look at the payment options that Klarna offers:

- Installment

Customers can split their purchase into four equal installments without paying interest or additional fees. - Financing

For larger purchases, Klarna offers flexible financing options from 3 to 36 months. - Payment within 30 days

You allow your customers to try the product before they pay for it. As a seller, you get paid upfront, leaving all the risk to Klarna.

Typical Features of a Klarna Similar Apps

You don’t have to offer a “buy now, pay later” feature like Klarna does, but there are a few features that every mobile payment app should have. These include:

✅ Sign-up

The user is expected to enter their contact number and after the data has been verified, they will be taken on board.

✅ Notifications

Remind your users in advance of their payments so they don’t miss a single payment.

✅ Featured Stores

Show your users the brands you partner with so they don’t have to wander around to find them.

✅ Automatic deductions

Don’t bother your customers with complicated payment methods; instead, the amount due may be automatically deducted.

✅ Account Management

All upcoming payments are sorted up to date and reported to the user from time to time.

✅ First-class security

The world is becoming digital and users save all their personal information in apps. This provides a profitable opportunity for cyber attackers. The loss of business or customer data can cost your business not only money but also customer trust and loyalty. Thus, most payment applications have a reliable and effective security system.

✅ Performance

Consumers want to make payments quickly. They are always looking for fast, easy-to-use, and high-performance solutions. Most apps are lightweight and load quickly to ensure your customers don’t turn away from a terrible experience.

✅ Portability

Most mobile payment apps allow users to deposit money and make transactions through multiple channels. Most people use e-wallet apps because of this functionality.

✅ Reward system

In a cutthroat promotions market, this is a great way to easily and effectively attract customers. Mobile payment apps have built-in loyalty program features, so you can easily attract both existing and new customers.

✅ Categorization

Providing this feature can go a long way in improving the user experience for your application. The categorization feature ensures that all credit cards, debit cards, online banking, and other payment methods are organized into different categories. This makes it easy for customers to choose their favorite payment method.

✅ Budgeting

Providing budgeting capabilities in mobile payment apps is optional. This feature allows users to track their expenses and better manage their finances.

✅ In-app capabilities

Modern mobile payment applications are more than just transaction terminals. They allow you to use functions such as shopping, booking hotels and flights, and paying bills in the application.

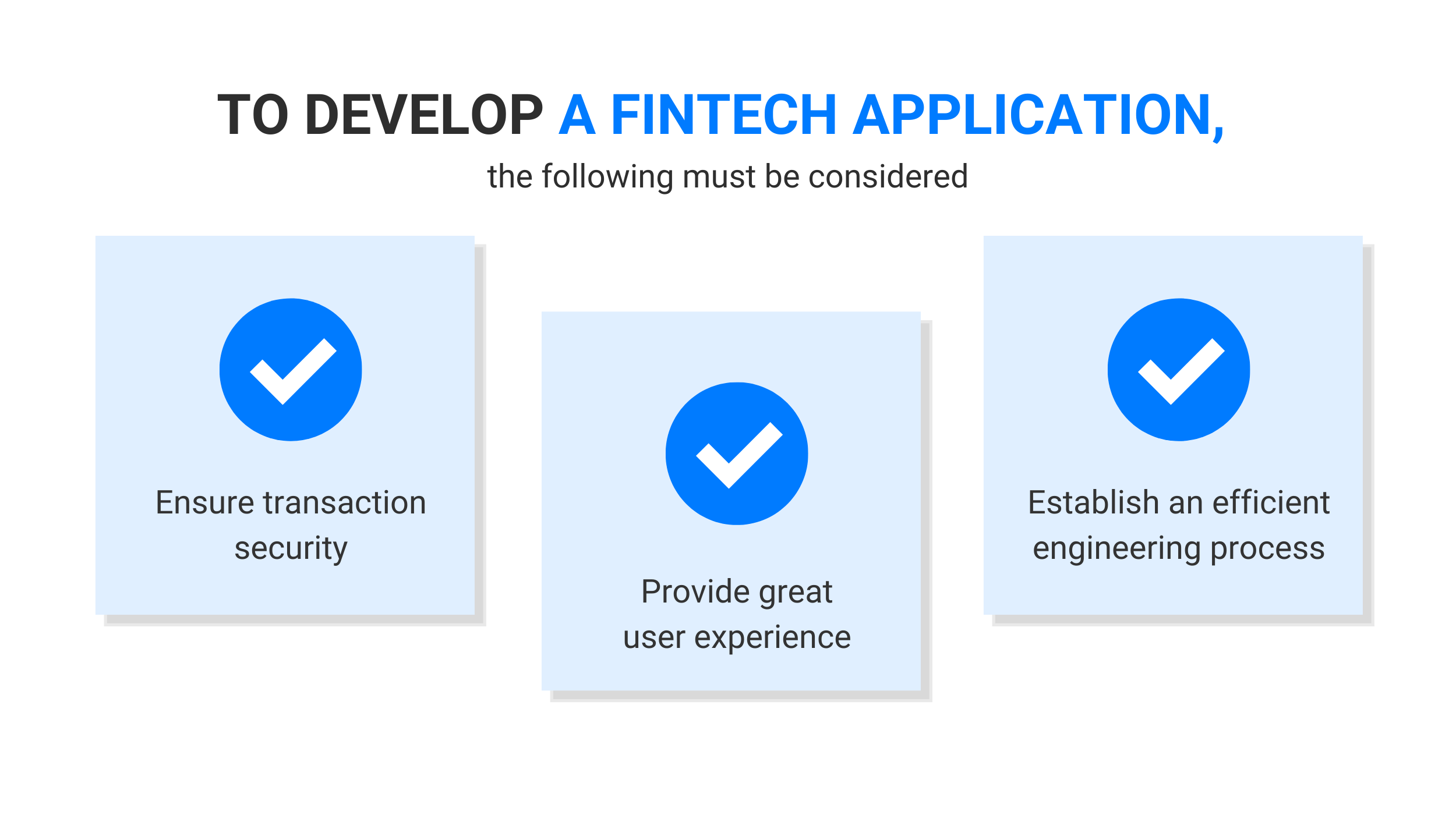

Tips to Consider Before Klarna Clone Development

To develop a fintech application, the following must be considered:

📌 Ensure transaction security

E-commerce fraud increased 30% compared to 16% in e-commerce sales. Such a significant increase in fraud cases compared to real sales makes developers seriously think about ways to ensure the security of transactions.

📌 Provide great user experience

Because so many applications are developed every day, coders must ask themselves if their application solves a particular problem. You need to make sure that your customers need your application; which is well designed and easy to use.

📌 Establish an efficient engineering process

Having an efficient engineering process is an important part of developing an e-commerce software solution. Due to the rapid development of fintech application development technologies, it is quite common for fintech application development projects to fail after they have passed the idea phase.

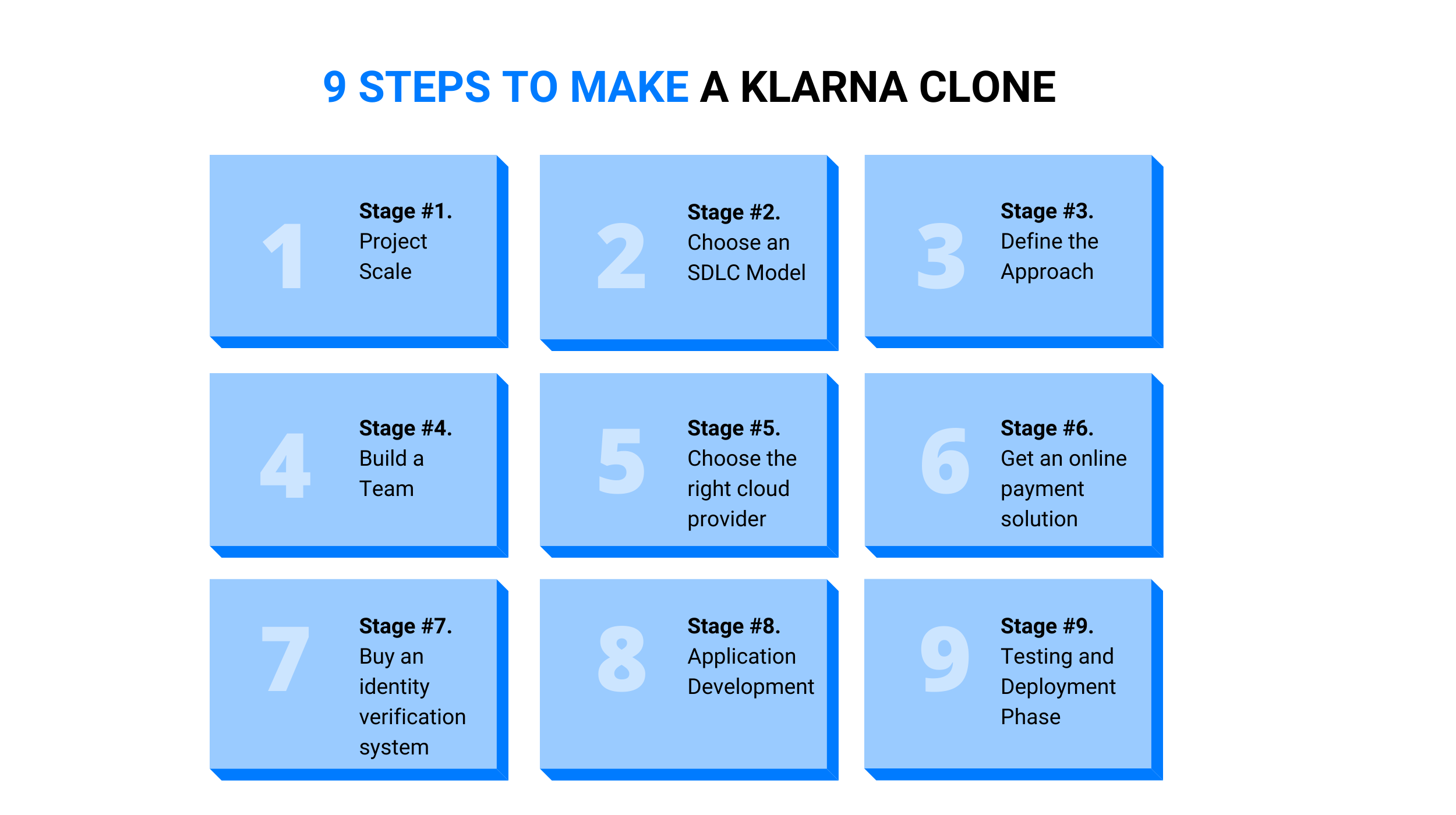

How to Create a Klarna Clone: Main Steps

The success of the Klarna mobile payment app has attracted the attention of many programmers. Most of them started brainstorming how to develop a mobile app like Affirm or just a Klarna related app. Below are the steps you need to take if you want to build the app:

Step #1. Project Scale

If you want to create a mobile payment solution like Afterpay, Klarna, or Affirm, get a better idea of the project. You need to know exactly what features to enable and understand the platform you are building for.

Step #2. Choose an SDLC Model

Choose the right SDLC methodology for your project that will make the development process productive and time-efficient.

Step #3. Define the Approach

Determine your ideal app development approach — ask yourself if you want to use PaaS, SDK, or API in your project.

Step #4. Build a Team

Having dedicated teams of software developers affect the success of a project. The team often consists of a project manager and developers with the appropriate skill sets to work on the project.

Step #5. Choose the right cloud provider

Cloud solutions are the best alternative for fintech startups, allowing you to access great IT infrastructure without having to develop it yourself.

Step #6. Get an online payment solution

You can use an API or SDK to implement important online payment functionality.

Step #7. Buy an identity verification system

An identity verification system is a regulatory requirement for online payment service providers. ID.me has become the standard in the financial industry.

Step #8. Application Development

Instead of acquiring the necessary technology for a project, you may want to consider outsourcing the software development task. This will save you the time and financial resources needed to acquire the right technology and skillset to work on your project. Many companies consider the outsourcing strategy in Ukraine to be suitable for e-commerce companies that want to build fintech applications at affordable prices. This will help you get your project up and running quickly and shorten your application startup cycle.

Step #9. Testing and Deployment Phase

Do a lot of testing before launching the application to make sure that all areas for improvement are fixed. This reduces poor performance, bad reviews, and deletions.

Most Popular Similar Apps to Klarna

There are a lot of buy-it-pay-later apps these days, like Klarna, each with its pros, cons, and features, which we’ll discuss later in this article. The most popular among them are:

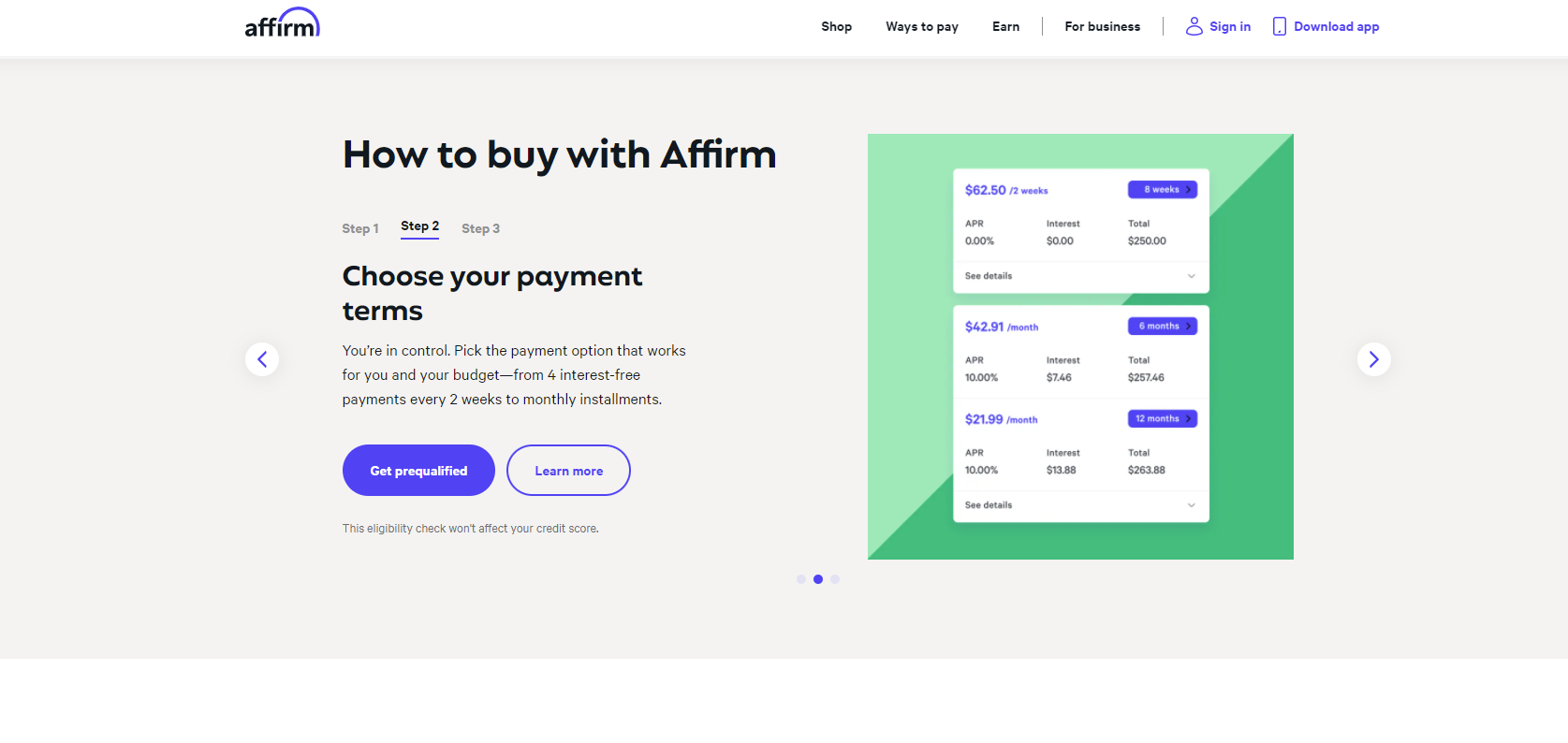

🔹 Affirm

When purchasing with Affirm, you always know exactly what you are paying for and when payments will be made. Many retailers offer to Affirm as a payment method at checkout. If this is not possible, you can still pay overtime by generating a virtual credit card number online or through the Affirm mobile app for in-store or online purchases.

🔹 Sezzle

Like many “buy now, pay later‘ apps, it requires an immediate 25% payment and three extra payments every two weeks. However, Sezzle allows customers to rollover payments for up to two weeks, making it the leader in flexible payments. The first schedule change for each order is free, then each additional payment change for the same order costs $5. You can even transfer your remaining payments during your first transfer at no additional cost.

🔹 Splitit

Just select Splitit at checkout, specify how many payments they’ll make to pay off the balance, and enter your credit card details — there’s no credit check. Splitit does not require an app or registration to use their service. Splitit does not charge interest or late fees. When you make a purchase, your available credit is reduced by the total purchase amount as a pending transaction on your credit card. Each time a payment is due, the payment will be charged to your card and the pending amount will be reduced by the same amount. The process is repeated until all payments are made.

🔹 Perpay

After completing your Perpay profile, customers can access their spending limit and start shopping within 60 seconds of joining. Your items will not be shipped until the first payment is made, which is usually the next payday. Instead of the typical four payments of 25% each that other BNPL services use, Perpay allows users to choose between 4, 8, 16, or 18 payments, and the frequency of these payments is the same as the frequency of their payments. Necessary payments are made by direct deposit from your payroll. Other forms of payment are not accepted unless you make additional payments.

🔹 PayPal Pay

PayPal is one of the most popular payment processing platforms for payments between individuals. Over the years, it has expanded to in-store and online shopping and is now one of the most recognizable payment methods among consumers. Pay in 4 is available at millions of online merchants such as Coach, Best Buy, and Vineyard Vines for transactions ranging from $30 to $1,500, making it our choice for smaller purchases.

How to Make Money with a Klarna Clone?

Klarna does not charge customers for making any purchase but instead charges retailers a transaction fee for all payment options. Klarna charges $0.30 in transaction fees and an additional variable fee of up to 5.99%. In addition to this, Klarna cuts a percentage of every sale the business makes.

Klarna believes that retailers are willing to pay these fees because their services help increase sales. The ability for consumers to pay in installments is estimated to increase the average cost of their order by 45%. Consumers using the 30-day payment option are 20% more likely to shop. Those who finance their purchases tend to spend 58% more on average.

Here is the list of the monetization models you can use in your Klarna clone.

- Initial installation fee

Every brand that partners with you have a chance to increase their sales as your app acts as an aggregator. So, make them pay the down payment. - Fine

Missed payments cannot be accepted; each unsuccessful payment is punished with an additional commission. - Monthly payments

The longer a brand or seller stays with you, the higher their sales and revenues, and you deserve to be paid monthly for bringing more customers to them. - Transaction fee

As a payment app, numerous transaction apps need to be done through your app, and is charged per transaction can overwhelm your gigantic vaults.

How Much Does It Cost to Build an App Like Klarna?

Now that you know what technologies and processes are involved, let’s talk about costs. In a nutshell, there is no specific price for developing a mobile payment application. It depends on many factors such as technology, features, functionality, development speed, and more.

We offer web development services starting at $34.50 per hour and extended team & staff augmentation $4800 monthly. Feel free to contact us via email 👉 andrew.gromenko@code-care.pro or a contact form to get a precise estimation.

What Technologies You Should Choose

Security and performance are the basis of financial applications. Thus, technologies for payment solutions must solve these problems. Below we have listed the main technologies that should be used.

✔ Front-end: HTML, CSS, and JavaScript

✔ Framework: React.JS

✔ Back-end: Express.JS/Nest.JS

✔ Mobile: React Native

✔ Database: PostgreSQL

✔ Push notifications: Amazon SNS/Push.io/Twilio

✔ APIs: Mandrill, Nexmo

✔ Cloud: AWS

✔ Real-time Analytics: Google Analytics

Wrapping Up

As the wave of e-commerce sweeps across countries due to the increase in the number of smartphones and the global pandemic, consumers have shifted their interest to online shopping. Little by little, the future of business seems to lie with online models built on mobile solutions and experiences.

Most e-commerce companies use outsourcing to create fintech applications for fintech developers. This helps them stay competitive by offering pay-later purchase solutions to customers.

Read More in Fintech:

How to Start a Neobank: Main Aspects, Key Features, and Cost

How to Make a Money Transfer App [An Interactive 5-Step Guide]

All-in-One Guide to Mobile Banking App Development

Popular

Latest